Small Business Grants and Loans for Coronavirus [Updated 08/31]

Whether you're in the travel industry like me, running a coffee shop, or fancy yourself a freelance software developer, small business owners everywhere are seeing their bank accounts drain at an alarming speed. We could all use a small business grant to help us through this pandemic, right?

Yup. A small business grant sounds soooooo dreamy. You know what else is dreamy? In this update, we included a small business COVID relief grant and loan calendar. Woo hoo!

In this update, we included a small business COVID relief grant and loan calendar.

Grant calendar, you say? There's still grants and loans available? 1 Yep, there are. We pruned out the ones that were no longer available, but there's a few deadlines on the horizon, so hustle!

But beyond the Payroll Protection Program (PPP), what's out there to help small businesses? We're in need of help and we want to help others. There's a zillion different fires to put out right now and it's easy to feel helpless. Personally, I don't have the money to offer small business grants to keep people afloat during the coronavirus crisis. What can I do to help other entrepreneurs? Then ... lightbulb moment!

I realized my own research on small business grants IS the way to help. Why have all of us scour the web for hours finding small business grants to help us weather the COVID-19 pandemic? Let's share the knowledge!

Not sure how to help? An easy way to make a difference is to share this post with a fellow entrepreneur.

If you're feeling overwhelmed and not sure how you can help others, here's an easy way to make a difference. Share this post with a fellow entrepreneur. A small business grant could mean the difference between keeping their doors open and shutting up shop.

Now, let's jump in and wade through the small business grants that are out there, starting with government grants and moving into private sector grants. Grab your swim trunks and suits, ladies and gents, it's time to dive deep! Here's a preview:

⭐️ SHORTCUTS Small Business grant & LOan RESOURCES: ⭐️

- Federal Grants

- State Grants

- City & County Grants

- Small Business Grant Resources

- Non-Government Grants and Loans

- Check out Our New Grant Calendar Here!

Federal Government: Coronavirus Small Business Grants and Loans

The federal government's small business grants programs are dominating the headlines so you're likely familiar with them.

Payroll Protection Program

Procrastinators may be rewarded: PPP loans reopened on July 6th and are available until Aug. 8th for a 24-week term. If you haven't already, apply to the (newly replenished) Payroll Protection Program (PPP). The goal is to help keep employees on payroll, even if you're the only one at the company. The Small Business Administration (SBA) will forgive the entire loan if:

- All employees are kept on the payroll for eight weeks and

- The money is used for payroll, rent, mortgage interest, or utilities and

- At least 75% of the forgiven amount must have been used for payroll

Any self-employed individual can apply, even if you're a sole proprietor or an independent contractor.

The requirements to apply are pretty easy to meet. Your company must have fewer than 500 employees (or fewer than 500 employees at one location if you're a restaurant/accommodation). What's beautiful about this is that any self-employed individual can apply, even if you're a sole proprietor or an independent contractor.

The best place to apply for the PPP is the bank you currently work with. However, if you're like me and your bank isn't currently doing SBA loans (sad face), you may have to find another bank to work with. Here's a list of the banks that will process PPP loans.

Economic Injury Disaster Loan

This federal program is meant to offer small businesses a lifeline by offering stopgap funds immediately after a disaster occurs. While the EIDL reopened June 15th, offering two types of relief

- EIDL Advance: Basically a loan that can be forgiven. Unfortunately, all advances have been allocated as of July 11th. Sad face.

- EIDL Loan: Application for this loan are still open. First payment is deferred one year and has a maturity date of 30 years, with a 3.75% interest rate attached to it (2.75% if you're non profit)

So if you're in the market for a loan, you can throw your hat into the ring and apply for up to 2M. However, rumor has it that EIDL loans are capped at $150,000 (according to widespread media sources, but not disclosed on the SBA site).

estimated TAXES

While not a grant or loan, I want to mention taxes. Small business owners can help their cash flow by not overpaying on their estimated taxes.

What do I mean by this? Travel has been hit hard and I don't expect it to rebound for awhile. Here at HAR, I'm expecting revenues to be down—gulp—SEVENTY PERCENT this year. And keep in mind, that's down 70% before our expenses. (That's worse case scenario, so let's hope I'm wrong!)

My estimated taxes this year are just that, estimates. More importantly, those estimates are based off last year's revenues. They're assuming that 2020 will bring in around the same amount of revenue. HA! Hardly. :) HAR is likely to be in the red for 2020, which means I shouldn't be paying in taxes on earnings that aren't going to be coming. I'm keeping that cash for important things, like cookies . . . and payroll.

So, do some financial projections and talk to your accountant about revising your estimated taxes numbers.

Not sure what estimated taxes are? Read this.

State Government: Coronavirus Small Business Grants and Loans

Okay, let's review:

- You applied for the PPP loan, which will give you a lifeline for the next 2.5 months of expenses. Great job!

- You've talked to your accountant about revising your 2020 estimated taxes. Huzzah!

Next step? Find the small business grants through your state government.

Next step? Find the small business grants through your state government. Keeping track of the small business grants at the state level is A LOT of work . . . and lucky for me, has already been done. :)

I just discovered there is an organization called the National Governors Association! There's an association for everything, I tell ya. Anyhow, on their site they have your state government's responses to coronavirus. You'll find a list of all the actions taken, and in there, you'll find if they passed any legislation to help small business at the state-level (and a link to more details about the small business relief package).

Want more? Local Initiatives Support published this free downloadable resource that outlines COVID funding relief for small businesses state-by-state (*swoon*).

Psst! If you start at the end of the action list of your state, you can start with the most current actions and work your way back.

County/City Government: Coronavirus Small Business Grants and Loans

Don't overlook that your city or county may be offering support small business grants during the coronavirus pandemic. If tracking the state-level small business grants was a lot of work, imagine what drilling down to the city-level is like. I haven't been able to find a one-stop shop to help track localized grant and loans. Have you? If so, comment below.

In the meantime, Google it. Just type in "coronavirus small business relief [your city/county]" or "coronavirus small business grant [your city/county]".

And if the interwebs isn't your thing, pick up the ol' phone and call the mayor's office to ask. Or try a smoke signal (results may vary).

Small Business Grant Resources

There's a few resources I wanted to mention before listing out specific grants from the private sector. These are websites where you can find a LOAD of small business grants. You'll find there is cross-over but I wanted to give you the opportunity to do some searching yourself in case you're the random person that would qualify for the grant aimed at small business owners in need, who also teach hopscotch. There's some pretty darn specific ones out there. ;)

- Inc.com's list of small business grants (Yay! Inc.'s resources is continuously updated. Bless you, Inc.)

- Forbes' list of small business grants and loans for COVID

And here's the top four grant directories I found — you should DEFINITELY explore them:

1. Duke University's grant and loan directory

I don't want to play favorites, but when you have a favorite, it's hard not to. Duke's directory is my favorite! Not only that, but Duke totally revamped their directory in May, so it's even snazzier than we first published this resource.

Worth noting: you can also find global grants and small business grants for countries around the world on Duke's resource.

Duke University's small business grants and loans directory is by far the most valuable resource in this whole article so check it out. 👇👇👇👇

THANK YOU, DUKE UNIVERSITY!!!! Search for 220+ small business grants and loans by state.

Worth noting: you can also find global grants and small business grants for countries around the world on Duke's resource. Above we link to the grants for small businesses, but they also have a list of over 190 small business loans.

2. gusto small business relief resources

Like Duke's directory, Gusto is a great hub to search for small business grants through federal and state governments, as well as those through the private sector. I found Duke's directory better organized and easier to navigate, but with 550+ listings—grants and loans—Gusto's Small Business Relief Resources is also another gem to check out.

3. GrantWatch.com's Small Business Grants

You'll find small business grants for just about everything on GrantWatch.com, including grants for businesses in need due to, uh, I dunno, the world falling apart from a tiny little virus with big ambitions. Here's where to find their coronavirus grants (yellow highlighter):

It's got more of a circa early 2010 look, but don't let that put you off. It has some handy search filters to help you wade through things.

GrantSpace.com Small Business Grant Listings

This is smaller list, but nicely curated list of small business grants. According to GrantSpace.com, their small business grant list is updated daily so you may want to bookmark it and do some quick glances every week to see if there is anything new. Most of the grant windows are just a week or two so it's important to keep looking!

Non-Government Small Business Grants and Loans for Coronavirus

And now the good stuff! Here's a list of lesser-known private sector small business grants for those affected by the coronavirus pandemic.

Verizon small business recovery fund

Verizon has partnered with the Local Initiatives Support Corporation (LISC) to create the Verizon Small Business Recovery Fund, bringing small business grants up to $10,000 to offer critical relief and resiliency-building support. Applicants must be small businesses facing immediate financial threat because of the COVID-19 pandemic. Entrepreneurs of color, women-owned businesses and other enterprises in historically under-served places who don’t have access to flexible, affordable capital are especially encouraged to apply. (And it's not just lip service, 87% of businesses awarded grants in the first round were minority-owned, including 47% to African American-owned businesses 2.)

- If you are selected as a finalist, business owners will be asked to provide verification documentation

- Being selected as a finalist does not guarantee you will receive a grant

- You will be notified when your application is being processed. Businesses that have not been selected as finalists will not be notified.

- If you are not selected as a finalist, you can re-submit your application in future rounds. Sign up for announcements when future application rounds open up.

Before completing the application, LISC recommends you review our Grant Information Overview and FAQ, which can be found here.

The 6th round of funding is open. Deadline to apply is Monday Sept. 7th 11:59ET

hello Alice's COVID-19 business for all Fund

While applications for Hello Alice's COVID-19 relief grants are closed, they're offering 15 small businesses grants awarded under their general Business For All grant in fall 2020.

Deadline to apply is September 25, 2020, at 12:00AM Pacific Time. Apply here. If you've submitted an application for COVID relief but were not awarded, your prior application will automatically be entered into the pool for a general grant.

THe red backpack fund

Spanx, anyone? Yup, The Red Backpack Fund is for the ladies. Spanx creator, Sara Blakely laid down $5M to support female entrepreneurs in the wake of the coronavirus. At least 1,000 small business grants for $5,000 will be awarded to business that are majority women-owned. The remaining criteria:

- You are at least 51% majority women-owned

- You have withheld payroll taxes for at least one employee in addition to yourself (unfortunately, we are unable to accept applications from sole proprietors or individuals who exclusively employ contractors at this time)

- You are registered in the U.S. and its territories as a legal entity and have a valid EIN number

- You have fewer than 50 employees

- Your annual revenues did not exceed $5M in any of the past three years

- You are 18 years or older

Each month, they will accept additional applications for the small business grants. The portal will open for applications again on August 3. Sign up to be notified when applications are open.

Gofundme.org small business relief fund

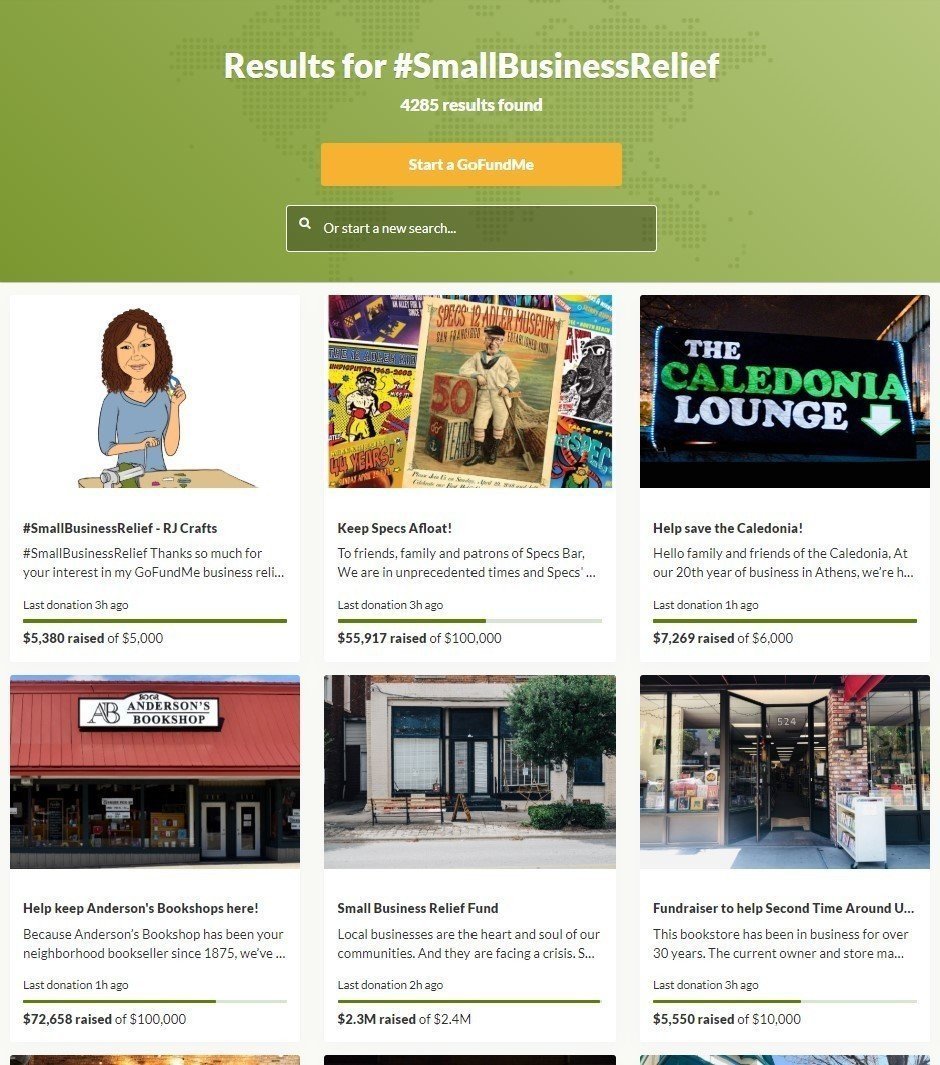

A partnership between GoFundMe, Yelp, Quickbooks, GoDaddy and Bill.com, the GoFundMe.org Small Business Relief Fund is offering matching grants of $500 to small businesses affected by COVID-19. As of July 10th, GoFundMe issued their 14th round of grants and is still going.

How exactly does a matching grant work? It's pretty simple. The big partners listed above seeded the fund but it stays alive through individual donations that are still rolling in. To access the $500 matching grant for your business, set up a fundraiser on GoFundMe.com and use the hashtag #SmallBusinessRelief.

Ask your friends, family, clients to donate $25 to help keep your company afloat. Once you hit the $500 raised on your own, you'll be eligible for the matching $500 small business grant.

Here are the other requirements that need to be met:

- Raise at least $500

- Verify that your small business has been negatively impacted by a government mandate due to the COVID-19 pandemic

- Be independently owned and operated small business

- Must not be nationally dominant in your field of operation

- Must intend on using the funds to help care for your employees or pay ongoing business expenses

The other beautiful thing about the campaign is when you do a search for #SmallBusinessRelief on GoFundMe.com, you can see what other companies have done to raise money. I'd encourage you to be specific on what you need help with, how you plan to use the money, and to tell your personal story. And most of all, aim to raise what you need, not just the $500 minimum!

Ready to get going? Start your campaign on GoFundMe and fill out this form to apply for a $500 match.

Be inspired! See what other small businesses have done to raise money for their companies.

Lurn's startup RELIEF FUND

Lurn's Startup Relief Fund will help entrepreneurs and small business owners by providing emergency grants ranging from $50 to $500 to help with necessities such as groceries, medicine, transportation, etc. This is an ongoing relief fund since they raise money and as the donations hit thresholds, they distribute the money to applicants. Apply here.

They've fulfilled their first two rounds and are continuing their funding efforts.

Virginia 30 Day Fund

The nonprofit Virginia 30 Day Fund has forgivable small business loans for Virginia-based companies. It was launched by Virginia technology entrepreneur Pete Snyder and his wife, Burson. The goal? To help save as many Virginia jobs as possible. The fund is designed to get the money to small businesses in need SUPER quick (3 days!).

Here's the qualifications:

- Employ 3-30 people

- Based in Virginia and operating for at least one year

- Owned and operated by a Virginia resident.

Like what you're reading? Me too. Better yet? Their application deadline is listed as Dec. 2023 (no that is not a typo!) so you plenty of time. The Bursons seem like such nice folk. Apply here.

Small Business COVID Relief Grant Calendar

Hard to keep all these ducks in a row? Check out our grant calendar below. We'll update it as we update the article. You can click on the field to get a refresher on the grant (and a link to the application). If you want to send it to your iCal, click on the ellipses above the calendar to copy it over.

The "Stay Tuned Group" of Small Business Grants & Loans

Below is a list of resources that may open for applications in the future. I encourage to sign up for their notifications so you can be alerted to available funds.

Freelancer's relief Fund

[07/23/20] The Freelancer's Fund is not currently accepting applications, but members will be notified if/when applications reopen. Sign up here to become a member (it's FREE)

Well how about that for being stand up? The Freelancer's Union—which is exactly what you'd guess, a union fighting for the rights of freelancers—created a relief fund to help solopreneurs who have been hit hard by the pandemic... and they don't require applicants be members (although it helps). 👏👏👏 Um, did I mention it's FREE to join?

However, that said, their first round of funding has closed and they'll be emailing members an update when it reopens. So, join the union, or set a reminder to check back on the Freelancer's Relief Fund.

The small business grants come in the form of $1,000 per household to cover lost income and essential expenses. Other qualifications include:

- Resides in the United States.

- Must have performed freelance work as their primary source of income for at least one year prior to their application. Eligible freelance businesses include sole proprietors, limited liability companies, or other entity provided there is no more than one employee.

- Sudden decrease of at least 50% of income as a direct result of the COVID-19 pandemic, including those experiencing contract cancelations or loss of work due to social distancing measures, experiencing COVID-19 illness or caring for immediate family members infected with COVID-19.

- Tangible documentation of freelance income and income loss by providing the following supporting documents: 2019 tax filings or annualized financial statements; two consecutive months of 2020 financial statements; canceled contracts or relevant client communications

Doonie Fund

[07/23/20] The Doonie Fund is no longer accepting applications but encourages eligible business owners to sign up here to learn of ongoing grant initiatives.

The Doonie Fund is set up to help black female entrepreneurs affected by the coronavirus with $100 grants. The requirements are a little more opaque and you're required to fill out a quick form to see if you are eligible.

Good luck!

We hope that helped you discover some small business grants that can help you endure the coronavirus calamity. From one business person to another, I feel you. We're in this together. ❤️❤️ Let us know if there are other tangible ways we can help.

PS: A disclaimer. (Sigh. Boring.) While we spent hours researching and digging through virtual stacks of grants and loans, we have NOT vetted the programs. Please be do your research before applying and giving out private information like banking statements, social security numbers, financial reports.

PPS: The internet is a big place. Did we miss any small business grants? Share them in the comments!

This post was originally published on April 23rd, 2020 and was updated and republished on July 23rd to reflect the most current information on small business grants and loans during COVID.