How to Protect Your Travel Agency from Credit Card Fraud

Where was I last month? Oh, nowhere.... just the PATH SYMPOSIUM! It’s like prom for host agencies—everybody’s there. 🙂 Well, maybe not everyone, but the hosts that were there represented roughly 15,000 agents.... so kinda?

Sadly, I forgot to take photos of the event. But lucky for us, Andi from MTravel was kind enough to share her photo with me to help brighten up the post (thanks Andi!).

Well, That's Done. Let's Talk Travel Agency Fraud

Ha! Now that I've suckered you in with a light-hearted (pun intended!) first paragraph and fun photo, I can get to the heart of the matter (and again!). The PATH Symposium never fails to discuss those not-so-fun business topics, like our write-up from last year's symposium, the complications of travel insurance licensing.

This year, one of the big topics discussed was fraud—something that’s applicable to every agency out there. More and more, travel agents are working in a “card-not-present” environment… and that opens the door to travel agency credit card fraud. Scary.

But fear not, young grasshoppers! In this article, we'll chat on how you can protect your travel agency from credit card fraud. We’ll be focusing mostly on airline fraud, but don't forget leisure-only agencies aren’t immune to fraud. So, even if you only sell packages and cruises, it's worth familiarizing yourself with some of the red flags!

Oh, and We're Planning a Webinar with ARC on Travel Agency Credit Card Fraud

UPDATE: It's here, it's ready! >> More details on the webinar

We're working on setting up a webinar with ARC on fraud protection for agencies. What can you expect to learn?

- The credit card acceptance process—authorization through settlement

- Best practices for managing risk in a card not present world

- The credit card chargeback policy

- Basic tips to increase your chances of "winning" chargebacks

- Tips for dealing with "friendly fraud"

If you'd like to attend, sign up for our newsletter to get details!

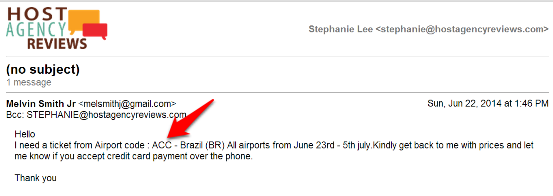

Meet Mel, of MelSmith@gmail.com

I’m sure that as an agent, you’ve received an email like this before. And if you haven’t, you will. :)

This particular fraudster—I feel comfortable calling him Mel, don’t you?—isn’t terribly sneaky in his approach (especially considering I don’t even sell travel) but his email has plenty of red flags:

1) Mel Uses Airport Codes

Who writes in airport codes but travel pros (and those trying to defraud them)?

2) Mel's Departure Date is Uncomfortably Close

3) Mel's Card is Not Present

Now I realize these red flags are common sense to most agencies. The fraud example above was obvious, but it’s not always that easy; fraudsters are getting more advanced (except, apparently, Mel).

What if Mel called in with a local number, sounded local, and sent in copy of the passengers' passports and credit card? Would that cause you to be less suspicious?

The PATH Symposium had a panel of fraud experts to go over the latest and greatest in travel agency credit card fraud:

The Game Keeps Changing, Becoming More Sophisticated

It's important to remember that fraudsters' schemes need to become increasingly complex to survive. The Mels of the Fraud World are easy to spot because their tactics are amateur. There are plenty scam artists that are much savvier than our friend Mel.

“[Fraud] is a moving target.” — Tim Delaney, Delta, Revenue Recovery

Jennifer Watkins shared one of the more robust schemes ARC has seen. The fraudsters contact an agency as a corporation and appear to be a promising corporate account. They even go as far as to build a reputable looking website to demonstrate they're a legitimate company. Then, they work with the agency and establish a relationship where all seems well.

"We've had a couple agencies get hit for over $100,000 [with corporate schemes]" — Jennifer Watkins, ARC, Credit Card Services and Fraud Prevention

They start ticketing with the agency, tickets all over the world. Nothing seems terribly amiss until thirty days later... the chargebacks comes. The "corporation" disappears. And guess who's left with the bill for those chargebacks?

What Red Flags Should Travel Agencies Look For?

The panel went over tons of red flags of fraud travel agencies should be on the lookout for. They seem to fit nicely into a few main categories:

1. LOCATION, LOCATION, LOCATION!

- Is the departure city in your vicinity?

- If you’re based out of Minneapolis and they’re out of New York, why would they be calling you instead of a local agency? Red flag.

- Does the billing address on the card match what they’ve given you?

- Often the scammers don’t know the address of the stolen card. Don't worry, that small hurdle wouldn’t deter Mel in the least. He’d just give you a fake address. Nip that non-sense before it starts!

- Verify via GDS prompts:

- Galileo S*BRF/CC ADDRS

- Sabre format-finder.sabre.com, keyword “AVS”

- Amadeus HEDE

- Worldspan INFO CK/ADDR

- If you don’t have the GDS, you can call the credit card companies' address verification departments.

- Address verification via CC companies:

- American Express (800)528-2121

- MasterCard (800)MC-ASSIST

- Discover (800)347-1111

- Visa (800)847-2750

- I verified my address on my card with Discover and the prompt asked for my merchant ID, which I was clueless about. When connected to a live person, I explained I was a travel agency and they said not to worry, they have a merchant ID for travel agencies. I gave them my card number, address, and zip code. After a short pause, they said it all checked out. Easy-peasy. :)

- Is it a local phone number on the Caller ID?

- Most scammers like to take the path of least resistance. Getting a local number is a hassle (especially if they’re calling agencies across the country). If it’s a local number that matches the area code for the billing address of the credit card, you’re less likely to be dealing with someone like Mel.

- That said, there are fraudsters that go the whole nine yards and get setup with local numbers.

- Are they flying to an ARC high risk city?

- This is the ARC list of high risk cities. If you get a call or email for a ticket to one of these cities + other red flags, beware.

2. FAMILIARITY: How well do you know them?

- Is the passenger also the card holder?

- Not many people are generous enough to give away their credit card number and allow someone else to charge airline tickets. If the name on the credit card isn’t a passenger, be veeeeeeeeeery suspicious.

- You may also want to get a Credit Card Authorization. You can do this through the service provider or through the credit card companies' Voice Authorization Services. This doesn't guarantee the card isn't fraudulent but will ensure the credit card is still active and not stolen:

- American Express (800) 528-2121

- UATP (800) 638-6510

- JCB International (800) 522-8788

- Merchant #: 0002016020

- Visa (800) 231-1754

- MasterCard (800) 231-1754

- Discover (800) 347-1111

- Merchant #: 6011 0160 1101 601

- Are they calling themselves a Dr., Priest, Rabbi, etc.?

- Beware of titles that instill trust. It’s mind trickery, I tell you! Don’t fall for it.

- The fraudsters like to use stories that have worked in the past. What stories have worked? (1) They may tell you they’re a doctor and arranging travel for an emergency patient (2) They say they are a rabbi/minister/priest that requires members of the congregation to travel the next day (3) They may claim to be a dispatcher that has truckers required to get to another location quickly.

- What if they send copies of their passports, licenses, and/or credit card?

- Just remember, it’s pretty easy to buy a template and create a fake ID or credit card in Photoshop. It took me less than 5 minutes to find a site that sold credit card and passport templates for Photoshop:

3. TIMING

- Is it last minute travel, especially international?

- This is a huge red flag. They ticket close to the date of departure because it doesn’t give you time to discover the fraud. Raise the alert level even higher if they have no qualms about the price.

Credit Card Chargebacks: Travel Agency Best Practices

Chargebacks come in many forms. It can be a result of some of the scanarios we mentioned above. It can be from a client that decided instead of paying a full cancellation fee, they would deny ever having purchased their tour. So, what you can do to protect your agency from chargebacks?

Let's start with what you can do to 100% prevent chargebacks. Realistically, nothing. Unless of course you want to do the following for every credit card transaction:

- Get an approval code.

- Pull out an ancient UCCCF (Universal Credit Card Charge Form) and get an imprint of their card. Include transaction amount on form. Your clients will sure to be impressed with your technology when you whip out your imprint machine!

- Don't forget to get their signature!

It's just not possible.

What you can do is mitigate your risk by looking out for red flags and keeping tidy records. Set yourself up by consulting with a travel industry attorney and reading our article on travel waivers.

If push does come to shove and you get a chargeback, ARC has a few recommendations:

- Reach out to your client to explain the charge. If it's a misunderstanding, have them contact the bank/credit card company.

- Provide documentation to backup the charge. What kind of documentation? Everything you got:

- Itineraries

- Invoices

- Emails

- Copies of Tickets

- A CC imprint if you happened to grab one (?!?)

- Forms such as waivers, terms and conditions, etc. signed by the client

- Respond as quickly as possible to the chargeback—if you don't reply within the allotted time, you forfeit your right to challenge the chargeback. ARC requires you reply within 5 days.

If you suspect your client is committing fraud (they took the trip but just don't want to pay), contact an attorney.

The Disclaimer + Resources

Speaking of lawyers, you know I'm not one, right? This article was written to help educate agents on travel agency credit card fraud but shouldn't be taken as legal advice or expert advice.

Here are some more in-depth resources for those that just can't get enough:

ARC Chargeback Prevention Tips (Skip to Part 3 for specific chargeback info)

ARC Card Not Present Red Flags

ARC’s Fraud Team:

Phone: 703-816-8137

Fax: 703-816-8138

Email: FIFP@ARCcorp.com

And don't forget, if you're interested in learning more, we're putting on a webinar with ARC soon! Join 39,136 agents and sign up for our monthly newsletter to get alerted when details come out... plus, then you can make sure you won't miss any future articles!

Let's Say Goodbye, Finally

I love you guys but I think it's time to wrap this thing up, don't you? If we haven't met, I'm Steph! I help agents connect with the right resources to start and grow their travel agencies. I also occasionally write insanely long articles on dry subjects. 🙂

I'm here to help you out. Drop me a line with any questions in the comments below!

Want to share, repurpose, reuse, or translate our content? Get information here about how to do that; we're under a creative commons license.

PS. You may be wondering how much fun I had while in Vegas, sitting in a conference room scribbling notes on travel agency credit card fraud. The answer is, a dandy old time! And not just because I awoke to the sounds of (what I thought was) a marching band out my window every night. Turns out, it was just the Mirage’s volcano exploding.